SBI (State bank of India) provides a facility to open an account online. Check here the step-by-step procedure on how to open an SBI account online.

Types of SBI Accounts

First, we have to understand how many types of accounts, SBI bank offers

Basic Savings Bank Deposit Account:

This type of account can be opened by any individual, for such type of account you only need to show valid KYC documents. This type of account encourages the poorer sections of society at least they start saving without any burden of charges or fees.

Features of basic saving bank deposit account:

- No upper limit and lower limit

- No minimum balance

- Cheque book facility not available

- Can avail only basic Rupay ATM-cum-debit card

- It is available at all branches of SBI

- Withdrawals can be done using ATMs and using withdrawal forms at branches.

Eligibility ad requirements for basic savings bank deposit account:

- Valid KYC documents are required to open a basic saving bank deposit account

- Singly, jointly, or with Either or Survivor, Former or Survivor, anyone or Survivor, etc. facility.

Important terms and conditions for basic savings bank deposit account:

- If you have been availing services of a basic savings bank deposit account, then you can not avail any other savings bank account. In case the customer has a savings bank account already, the same will have to be closed within 30 days of opening a Basic Savings Bank Deposit Account.

- In a month, only 4 cash withdrawals are allowed that are free of cost, including ATM withdrawals at your bank and other banks’ ATM, Cash withdrawals at Branch Channel.

Services Charges:

- No charges are levied on the closure of an account

- No charges on inoperative accounts activation

- Deposit/ collection of cheques drawn by State/Central Government is free

- The credit of money via electronic payment modes like NEFT/RTGS is free

- No annual maintenance charges on the debit card and issued to the customer at no cost.

Basic Savings Bank Deposit Small Account:

Due to the relaxed KYC, there are many restrictions are imposed on the operation of the account. Due to any reasons if you do not have valid KYC documents officially, then there is no issue, you get a basic savings bank deposit small account easily, you need to meet one criteria, your age should be 18 years. One advantage of this type of account, upon submission of KYS documents, it can be converted to Regular Savings Account. It is primarily meant for backward sections of society to encourage them to start saving at no charge.

Features of basic savings bank deposit small account:

- No need to maintain a minimum balance

- maximum balance of Rs 50,000/-

- Can avail of basic RuPay ATM-cum-debit card benefits

- Can withdraw the amount from the bank branch and ATM both

- It is available at all the branches of SBI bank

Eligibility and KYC requirements:

- As applicable to regular Savings Bank Account

- Need to submit self-attested photos and affixation of signature or thumb impression to the bank officer who is authorized to approve account opening.

Important terms and conditions:

- The balance should not exceed Rs 50,000/- at any point in time.

- All withdrawals and transfers should not exceed Rs 10,000/-aggregated in a month.

- The aggregate of all credits should not exceed Rs. 1.00 lac in a Financial Year.

- In any case, the balance exceeds Rs. 50,000/- or the total credit in the account exceeds Rs. 1,00,000/- in a year, after complete KYC procedure, the further transaction will be permitted.

- No further customer debits would be allowed during the month if you availed the maximum of 4 withdrawals in a month including ATM withdrawals at your own and other Bank’s ATMs and transactions through another mode including RTGS/NEFT/Clearing/Branch cash withdrawal/transfer/internet debits/standing.

- Foreign Remittances services are not provided in this account, if you want this service, then you have to show valid documents to the bank

- If you are unable to submit your valid documents within 24 months of opening the account then you can not avail of transactional services other than for the closure of the account.

- if you want to convert your Small account to a regular Savings Bank account or BSBD account (at the option of the customer) would be only done by the bank home branch manually after fulfilling all KYC requirements, thereafter the same account number will continue.

Service Charges

- No charges taken for closure of the account

- Deposit/ collection of cheques drawn by the Central/State Government will be free.

- Receipt/ credit of money through electronic payment channels like NEFT/RTGS will be free.

- No annually maintenance charges applied

- Offers basic RuPay ATM-cum-Debit card will be issued free of cost.

Saving Bank Account

After submitting valid KYC documents in the home branch of SBI bank, then you can avail the “saving bank account” services, every citizen of India can easily get this account, simply you are required to fill out a saving account form, need to attest all the required documents, just in a week you will receive account passbook and debit card both through the post to your provided address.

Features of saving bank account:

- Consolidated account statement at no cost

- The first passbook is issued at no cost to track your all transaction, in any case, if you lost your original passbook, then after paying some amount, you will receive another passbook

- Mobile banking

- SMS Alerts

- Inter-Net banking

- YONO Application

- State Bank Anywhere

- SBI Quick Missed call facility

- Free withdrawals based on the monthly average balance maintained with some restriction

- The facility of transfer of accounts via Internet Banking channel

- A nomination facility is provided

- No limit is imposed on the maximum balance

Saving account for minor:

Saving account for minor is also known as Pehla Kadam and Pehli Udaan. This account helps children learn the importance of saving money. Pehla Kadam and Pehli Udaan both of the accounts are saving accounts consisting of banking features like Internet banking, mobile banking, etc. All these features come with ‘per day limits’ to ensure that they spend the money wisely.

Features of saving account for minor:

- No headache of maintaining the monthly average balance in the account

- Maximum Balance Rs. 10 lakh

- In PhelaKadam: Cheque books are provided, offering customized personalized cheque books to the guardian in the name of the minor under a guardian.

- In PehliUdaan: customized personalized cheque books are issued, if the minor can sign uniformly.

- Auto sweep facility with a minimum threshold of Rs. 20,000/-. Sweep in multiple of Rs 1,000/- with a minimum of Rs. 10,000/-

- Under PehliUdaan: Photo embossed debit card with a withdrawal limit of Rs. 5,000/- will be issued in the name of the minor.

- In both accounts, you can avail mobile banking facility, per day transaction is limited to Rs 20,000/-

Eligibility criteria:

- PehlaKadam: This account will be opened jointly with the parent/guardian and minor of any age can avail the facility of this account.

- PehliUdaan: This account will be opened solely with minors above the age of 10 years who can sign uniformly.

- PehlaKadam: Jointly with the Parent or singly by the guardian

- PehliUdaan: singly operated

Important terms and conditions:

- For the PehlaKadam account, you are supposed to submit proof of date of birth and parents’ valid KYC documents.

- For the PehliUdaan account, the minor needs to submit his/her original birth certificate along with their parents’ KYC documents.

- Interest rate as applicable to savings bank account

- Without changing the account number. you can transfer your account to any SBI Branch

- A nomination facility is available and recommended.

- Customized passbook issued free of charge.

- Inter core charges NIL for transfer transactions.

Saving plus account:

Savings Plus Account is a Savings Bank Account linked to MODS, wherein a surplus fund above a threshold limit from the Savings Bank Account is transferred automatically to Term Deposits opened in multiples of Rs. 1000.

Features of saving plus account:

- Offer mobile banking and internet banking facility

- Offer ATM card

- SMS alert

- Offer facility of loan against MOD deposits available

- Minimum threshold limit for transfer to MOD – Rs. 35000

- You have the facility to transfer your account via internet banking

- Have no limit for maximum balance

- Unrestricted withdrawals based on the monthly average balance maintained

- 25 cheques are free annually. Further cheques will be issued with charges based on the quarterly average balance maintained by the customer.

- Minimum 10,000 you can transfer to MOD in multiples of Rs 1,000/- at one instance.

- Bank provides a passbook to track all the transactions at no cost, if the original is lost then you are supposed to pay some amount for a new passbook

- Bank sends account statements through email

Eligibility:

All individuals are eligible to open savings bank account having valid KYC documents

MACT claims SB account:

MACT accounts facilitate the customer to receive compensation amount given under the awards of the (MACT) Motor Accident Claim Tribunal.

Features of MACT claims SB account:

- Welcome Kit

- SBI Netbanking available

- Debit Card available

- Offer Cheque Book facility

- Offer nomination facility for individuals only

- Offer passbook facility

- Existing SB interest rate applicable

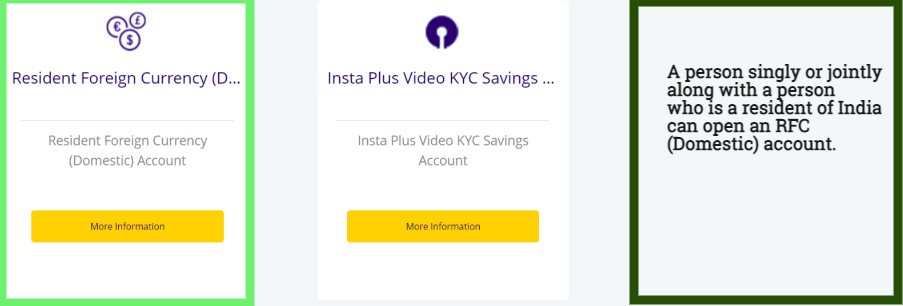

Resident foreign currency (domestic) account

Residents of India can avail the facility of this account in order to maintain foreign currency which you acquired through various modes. USD, GBP, and EURO currency can be maintained under this account.

Features of Resident foreign currency account:

- This is the kind of current account, under which you can get interest on the deposited amount.

- No ATM issued

- No Cheque book issued

- The minimum balance that needs to be maintained is EURO 500, USD 500 and GBP 250.

- The balance in the account is freely repatriable.

Eligibility criteria:

A person singly or jointly along with a person who is a resident of India can open an RFC (Domestic) account.

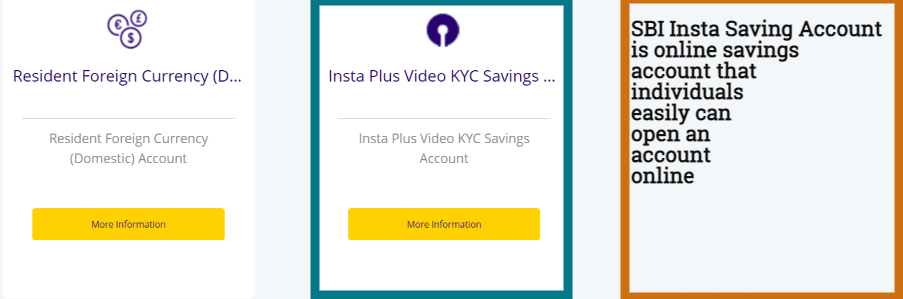

SBI Insta saving account:

SBI Insta Saving Account is online savings account that individuals easily can open an account online without visiting the nearest bank branch physically. Only you need to upload two documents which are PAN and Aadhar Card. A resident of India whose age is above 18 years can open get this account easily online. There are certain restriction like this account is active only for 12 months, and you can keep a deposit of Rs1 lakh only in the account, another restriction is that the total money credited to the account should be less than or equal to 2 Lakh in one financial year.

FAQs

Who can submit information online for opening a Savings Bank account?

Any person can open an account in SBI bank under one condition the person should be a resident of India.

Will KYC documents be required for all account holders?

For every account for which you are desirous have to submit KYC documents.

Can we open an SB account online?

Every person can open their account with the state bank of India, a minor can also open an account online after submitting valid documents, he/she should be 10 years old and able to sign uniformly.

Can I open SBI student account online?

With the help of either online mode or offline mode, you can apply for opening an account with the help of college.

Can I open SBI account with zero balance online?

Yes, you can open an account online with the help of the YONO app or through the official site of the bank (onlinesbi.com or sbi.co.in.). You need a mobile number that should be linked with your Aadhar card, PAN, and valid E-mail Id.