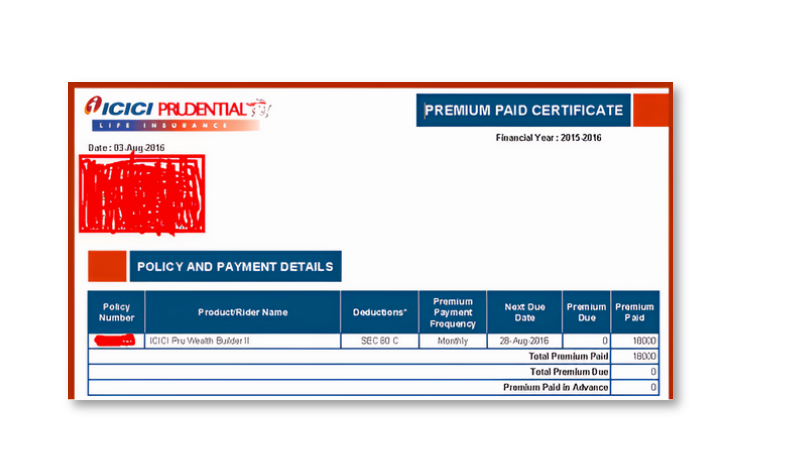

What is ICICI Prudential Premium Payment Receipt?

ICICI Prudential Premium Payment Receipt is a document where you see the total premium you have paid in a specific financial year for all purchased policies. This receipt work as investment proof for tax filing. You can download ICICI Prudential Premium Payment Receipt any time from anywhere but only after paying your premium.

Downloading ICICI Prudential Premium Payment Certificate is a hassle-free and simple process and will take not more than a couple of minutes.

How Do I Pay my ICICI Prudential Premium Payment?

Using any of the following modes to pay your premium amount online/offline

- Cash: If you are paying your premium in cash, then there is a limit, you can pay up to INR 49,999. Simply visit any authorised collection centre.

- Cheque: Simply you need to drop the filled cheque of the premium amount at any ICICI Prudential branches.

- Online: This is the secure and easy mode to pay your premium without going outside or standing in a queue unnecessarily, using ICICI net banking, UPI, debit card, credit card and e-wallets to pay your premium conveniently.

Steps to Download ICICI Prudential Premium Payment Receipt:

- Visit ICICI official website (“https://www.iciciprulife.com/services/download-premium-paid-certificate.html”)

- Before clicking on the “Proceed” button, enter your policy number and date of birth

- The receipt downloading option is available, go on to download and save on the local disk or request to send a receipt copy on registered mail id.

Bottom Line:

It is important to have a digital and hard copy of the ICICI Prudential Premium Payment Certificate. This receipt will work when you will get any dispute where you are requested to show any proof that you have paid all the premium in that situation you can prove yourself. There is another reason, you can get to know easily how many premium is already paid and how many are left to pay, and also help your nominee to the current status of the policy. It also helps you to file a life insurance claim.