How to Link Aadhar to PAN Card Online Step by Step

Linking Aadhar to PAN card is mandatory as per the Indian government guidelines, so if you are unaware of how to link Aadhar card with PAN card, then no need to worry, we provided step-by-step procedure to enable the linking between them. Check the below-mentioned steps so new users and existing users both can easily linking Aadhar and PAN card online

- Open the Income Tax e-filing portal – https://incometaxindiaefiling.gov.in/

- Get registered, if it is not done, Your PAN will be your login ID.

- Enter your user ID and your passcode and your date of birth.

- A pop screen will appear on your screen where you will get an option to link your PAN with Aadhar

- If not go and expand the profile setting on the menu bar and click on “Link Aadhar”

- Where your basic details already mentioned such as your gender, your DOB, and your Name as per PAN details

- Verify your PAN details with Aadhar card details; If there is any mistake, then will get it corrected in either of the documents.

- If your details are correct then enter your Aadhar number and click on the “link now” button.

- You will get a pop message “your Aadhar has been linked with PAN successfully”

- You can also visit https://www.egov-nsdl.co.in/ or https://www.utiitsl.com/ to link your PAN and Aadhaar.

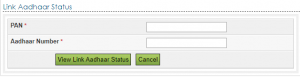

How can I check whether my PAN is linked with Aadhaar?

Here are the steps to Aadhar PAN card status :

- Visit this page https://www.incometaxindiaefiling.gov.in/home

- Go to Aadhar status

- Enter your PAN number

- Enter your Aadhar Number

- Click on”View Link Aadhar Status”

- Your linking status will be displayed on the next screen

Another method to check your Aadhar PAN status using Mobile Phone

Users are supposed to send an SMS to 567678 or 56161 and the SMS format should be like this

UIDPAN < 12 digit Aadhaar number> < 10 digit Permanent Account Number>

If the linking is already done, will display a message “your Aadhar is already associated with PAN”

If your Aadhar and PAN are not linked with each other, then you are supposed to visit the e-filing website of the Income Tax department as mentioned above, If you are looking for another method then you can use SMS based facility to link Aadhar to PAN.

According to CBDT, if both Aadhar and PAN are not linked before the provided deadline, then your PAN related services may become inoperative it means you no longer can be able to make any financial transaction where PAN is mandatory. There is the possibility, a user will have to pay a fine of INR 10,000.

How Long Does it Take to Link Aadhaar to PAN?

As per the UIDAI helpline, the turnaround time is usually 10 days. As per the finance act 2017, it is mandatory for taxpayers to quote the Aadhar card in the application form for filing ITR.

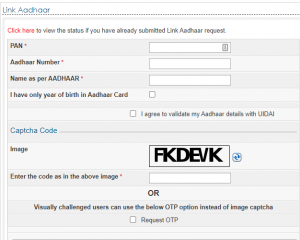

How can I Link My Aadhar Card with PAN Card Without Login?

There is another option to link Aadhar to PAN without login into the Income Tax portal. Check all the steps on how to conduct this.

- Go to Portal

- On the left-hand side, there is the option “Link Aadhar”

- You will get a screen where you are asked to provide your PAN number and Aadhar number.

- Fill captcha code as provided on the screen

- A visually challenged person can request for OTP instead of an image captcha

- Finally, click on the “Link Aadhar ” button

- If all the information is right then you will see a message “Your Aadhar-Pan linking successful”